Remembering Pro-Choice Washington Foundation in your will, a trust, or through an annuity is one of the most powerful gifts you can give to future generations of activists. As you make your plans, we hope you join a powerful community of supporters that are investing in the future of reproductive freedom in Washington.

Give a Planned Gift, Join the Legacy Circle

The Legacy Circle, our planned giving society, is a community of thoughtful supporters who are making a multi-generation impact by ensuring that every person can access all reproductive health options. With your planned gifts, Pro-Choice Washington can grow its endowment and enhance its programmatic impact.

Use this downloadable fact sheet to learn about about Planned Giving or email info@prochoicewashington.org. Let us answer your questions or set up a time to discuss in more detail.

Give Memorial and Honorary Gifts

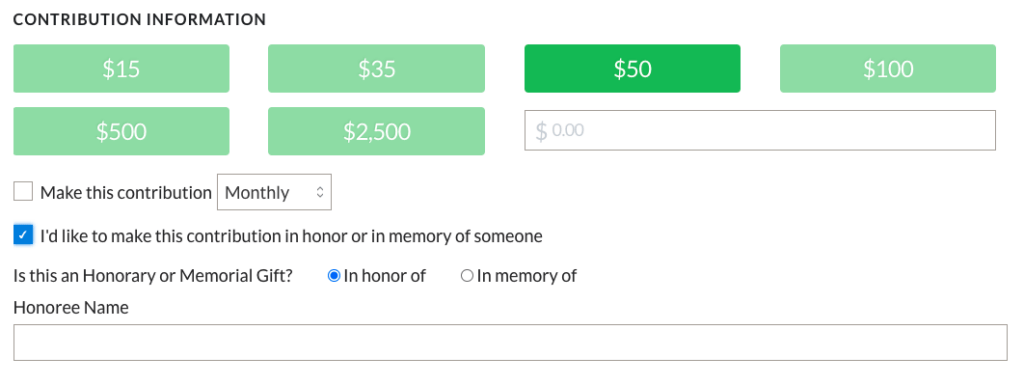

Show your love and support of someone in your life or honor a loved one’s memory by making a gift in their name. The easiest way is through our online giving platform: Check the box that says “I would like to make this contribution in honor or in memory of someone” and then complete the requested details (please see example below).

designate an honorary gift

Bequest

You can designate Pro-Choice Washington Foundation as the beneficiary of your asset by will, trust, life insurance, or beneficiary designation form. This is one of the easiest and most flexible ways that you can leave a lasting and impactful gift for reproductive freedom. Contact your attorney or life insurance provider to learn more about this process. Here is sample language for reference.

“I give (insert dollar amount, percentage of the estate, or “the remainder of my estate”) to Pro-Choice Washington Foundation, a nonprofit corporation, located at 1916 Pike Place, Suite 12, #1449, Seattle, WA 98101 for its general use and purposes. Pro-Choice Washington Foundation’s tax identification number is 91-1353222.”

IRA Qualified Charitable Distributions

For those who are 70.5 years old or older, donations up to $100,000 to Pro-Choice Washington Foundation can be made directly from your IRA, without treating the distribution as taxable income.

To do this, designate Pro-Choice Washington Foundation as a full, partial, or contingent beneficiary of your retirement account. Contact your IRA plan administrator to make a gift to Pro-Choice Washington Foundation from your IRA. Please note that IRA charitable rollover gifts do not qualify for a charitable deduction.

Please email info@prochoicewashington.org with any questions.